2014 Tax Planning Guide

As 2014 nears a close, the focus shifts from the election to post-election tax planning. Although Congress is still divided on many key issues, we expect an extenders bill coming soon.

In the meantime, the following are suggested planning tips to take prior to year end. BUSINESSES. Domestic Production Activities Deduction – This deduction allows U.S.

- 2015 Tax Planning Tables. 2015 important deadlines. Last day to January 15 n Pay fourth-quarter 2014 federal individual estimated income tax.

- As 2014 nears a close, the focus shifts from the election to post-election tax planning. Although Congress is still divided on many key issues, we expect an extenders bill coming soon.

Producers to deduct a percentage of their income attributable to their production activities. The deduction encompasses more than traditional manufacturing, as any significant transformation of a product could potentially qualify for this deduction.

© 2016-2017 Grant Thornton LLP. Member of Grant Thornton International Ltd.

It is advisable to examine potential production activities that could qualify for this deduction. Health Care Mandate – Companies with 100 or more full time equivalent employees are subject to the health care mandate starting January 1, 2015. These companies should evaluate potential exposure to penalties for failing to meet the requirements of the employer mandate.

Repair Rules – The IRS released final regulations regarding expensing vs. Capitalization of tangible property. Compliance is effective January 1, 2014, so capital intensive businesses should evaluate their exposure to the new rules and make proper tax elections when filing their 2014 tax returns.

Those businesses with audited financial statements wishing to use the $5,000 safe harbor for capitalization must have a written policy in place to claim the safe harbor as well. Depreciation Planning – Congress is currently working on an extenders package which will extend depreciation benefits such as 50% bonus depreciation and the $500,000 Section 179 allowance for up front expensing. Without these extenders, 2014 assets purchased would be subject to a Section 179 allowance maximum of $25,000 and would not be eligible for bonus depreciation. We continue to advise businesses planning to purchase assets before year end to make all necessary arrangements for potential purchases so they may act quickly to a Congressional extenders bill passing. Research Credit – This credit expired in 2014 but is expected to be in the extenders bill. Businesses should evaluate opportunities to claim the credit, as research is broadly defined to include technological discovery, process experimentation, and other such items not commonly thought to qualify as research.

They will feed much easier into the holes.

They will feed much easier into the holes.

State Income Taxes – State governments are continuing to push more aggressively against non-filers. We continue to recommend evaluating state income and sales tax nexus in the states that they do business in, even if not physically present in the state. Companies that operate electronically across the U.S. And those with heavy sales volume in non-filing states are the most at risk in this area. Deduction Acceleration – Traditional methods to reduce taxable income such as deduction acceleration by cash basis taxpayers are recommended for tax year 2014, as we see no significant rate increases in 2015. Therefore, cash basis businesses should plan to pay expenses before year end to reduce taxable income in accordance with their tax planning strategy.

INDIVIDUALS. Foreign Account Compliance – Individuals with foreign accounts should review past and present exposure for not complying with the necessary reporting requirements. Many of these reporting requirements carry significant penalties for failure to disclose information.

2014 Tax Planning Guide 2018 Canada

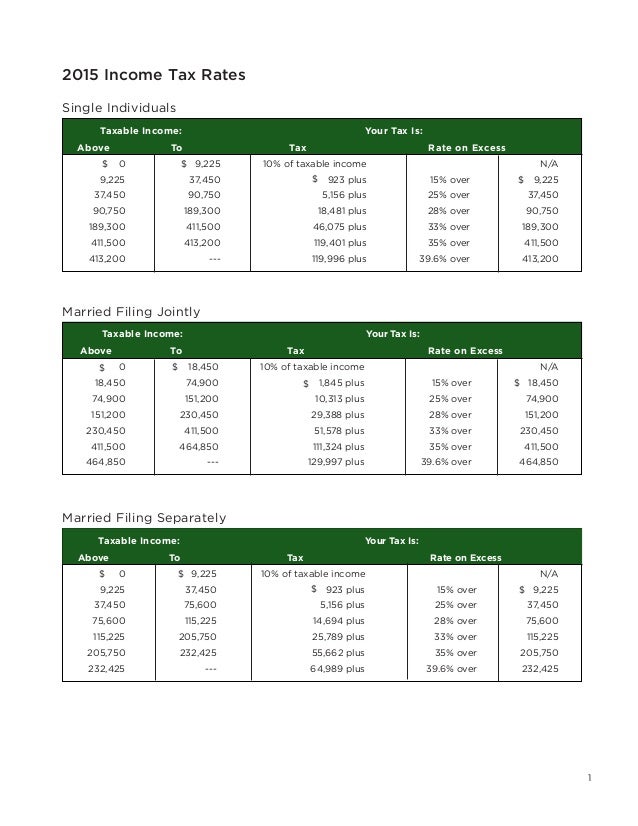

There are various voluntary disclosure programs available to many individuals who wish to extinguish any potential past liability associated with this issue. Tax Bracket Planning – Individuals with incomes in the $200,000-$450,000 range should continue to evaluate tax bracket planning, as exceeding certain thresholds will result in higher capital gains taxes and other additional taxes. These taxes can sometimes be avoided by proper tax bracket planning. Medicare Surcharges – As with tax bracket planning above, medicare surcharges apply when exceeding certain income thresholds. These surcharges include the 0.9% tax on earned income and the 3.8% tax on unearned income.

With proper planning, these taxes can sometimes be eliminated on a year by year basis. Health Care Mandate – The individual health care mandate is effective for tax year 2014. Those failing to hold coverage as of March 31, 2014 may be subject to a penalty.

Certain tax credits are also available to individuals whose employers fail to offer affordable coverage. Retirement Accounts – Individual Retirement Accounts (including IRA’s and Roth IRA’s) may be contributed to through April 15, 2015 for tax year 2014.

2014 Tax Planning Guide Pdf

Individuals should evaluate which type of IRA would be most beneficial given income limits on Roth IRA’s and deduction limitations for traditional IRA’s. For those covered by a Roth IRA income limitation, certain planning techniques may allow for contributions nevertheless. Medical Accounts – Flexible Spending Accounts (FSA’s) should be utilized before the year ends under the use it or lose it rule. Health Savings Accounts (HSA’s) can be contributed to through April 15, 2015 for tax year 2014. Those contributing through their employer should seek to maximize HSA contributions through their W-2 before the year ends. Investments – Individuals should evaluate investment accounts and 2014 capital gains/losses to optimize their tax planning. Those with gains should seek to use losses to offset the gains, and those with losses may want to take gains to prevent large accumulation of capital loss carryovers that would be unused due to the $3,000 limitation.